Monthly Income Fund

Monthly Income Fund

The Monthly Income Fund is designed to provide investors with regular monthly cash flow from real estate-focused lending.

The Fund invests in a diversified pool of short-term loans to qualified individuals and businesses involved in real estate, such as residential and commercial mortgages, land financing, development and construction financing, and other real estate–secured debt.

Targeted Annual Net Return of 7 – 9%*.

Monthly Income Fund Objectives:

Generate a stable, recurring monthly income stream derived from interest paid on short-term, secured real estate investments.

Maximize investors’ value with regular cash distributions payable monthly.

*Targets/illustrative scenarios are not guarantees; actual results may differ. See Offering Memorandum for details and risks. Please read full disclaimers here

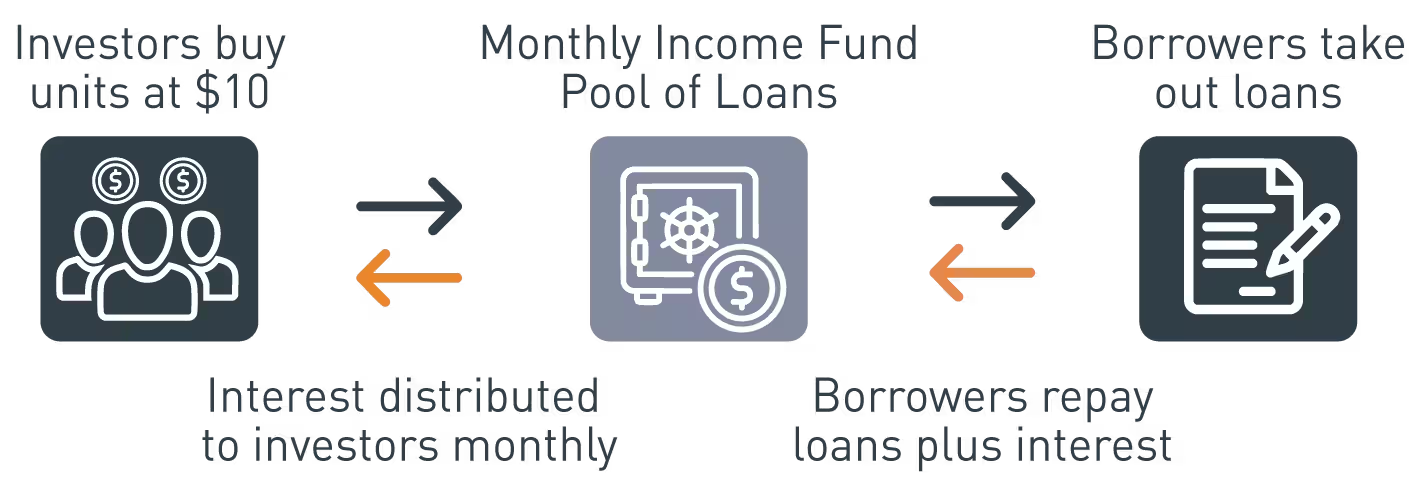

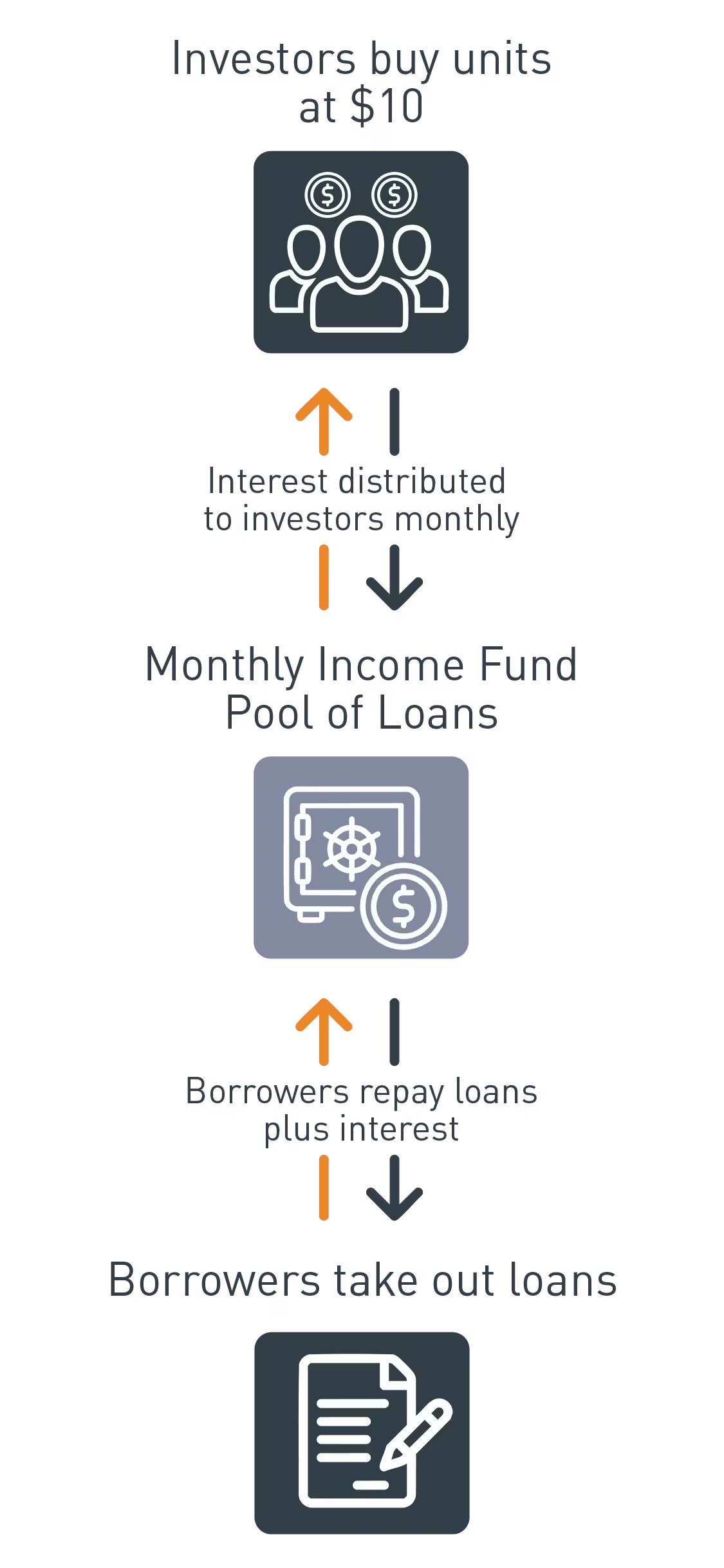

How it Works

How it Works

Key Fund Benefits

Regular Income: The Fund is designed to provide regular, monthly income through interest paid on short-term real estate loans.

Registered Plan Eligible: Investments can be held in RRSPs, TFSAs, RRIFs, RESPs and other registered accounts, allowing for tax-advantaged growth.^

Reinvest Distributions (DRIP): Benefit from compounding by reinvesting distributions.

Simple and Understandable: Earning interest on loans is a widely understood concept.

^Not to be construed as tax advice, please consult a tax professional for information about any potential tax implications.

FAQs

The Fund will hold a diversified pool of loans, primarily secured by real property located exclusively in Canada. Real estate lending assets can include residential mortgages (mainly 1st, 2nd); commercial property mortgages and financing; land financing; pre-development/ development and construction financing; and other real estate secured debt. The maximum weighted average property portfolio loan-to-value (LTV) ratio will be 75%.

The Monthly Income Fund is an investment that combines capital from multiple investors to provide short-term loans mainly backed by real estate. As borrowers make their monthly interest payments, the fund manager collects those payments and distributes the income to investors.

Equiton lends to qualified individuals and businesses engaged in real estate activities who may not meet the lending criteria of traditional financial institutions or require more specialized financing solutions not readily available through traditional lenders.

The average loan term undertaken by the Fund is expected to be less than 1 year and will typically be less than 3 years.

The Fund is designed to pay out distributions to Unitholders once a month. These can either be paid directly into your account or reinvested back into the Fund through our Distribution Reinvestment Plan (DRIP).

Lending directly requires significant upfront capital, involves administrative work, and carries personal risk. By investing through Equiton’s Monthly Income Fund, you gain access to professionally managed real estate lending opportunities, benefit from diversification across multiple loans, and enjoy the convenience of having our team handle all the paperwork and day-to-day administration. This approach also provides access to loan opportunities that may not be available to individual investors.

Who Can Invest?

*Varies by province, subject to suitability limitations.

**When working with an Advisor.

Equiton Investment Specialists

Contact our team today to learn more about how our investment solutions can help you invest like the wealthy and add diversity to your portfolio. For general inquiries: inquiries@equiton.com

Director, Private Capital Markets

Senior Associates, Private Capital Markets

Associates, Private Capital Markets

Questions?

Contact us anytime to learn more about private real estate investing.